Bond market – Inflation? What inflation?

If you have had the pleasure of reading any Macroeconomic research in the past three months I can guarantee there will have been comments about rising inflation rates and the potential for inflation to be stubborn and force central banks to raise interest rates. This is seen as a negative for risk assets as monetary conditions become less favourable across the board. Against this background you would expect to see bond markets start to price interest rate rises in via rising yields on long dated bonds.

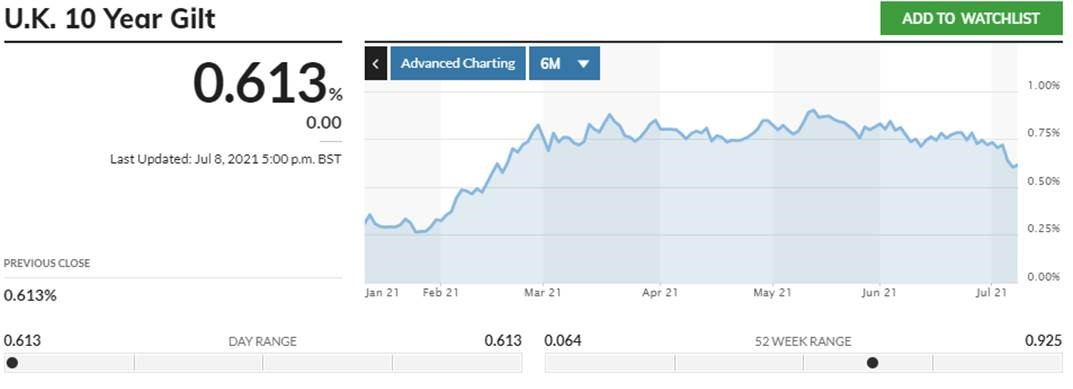

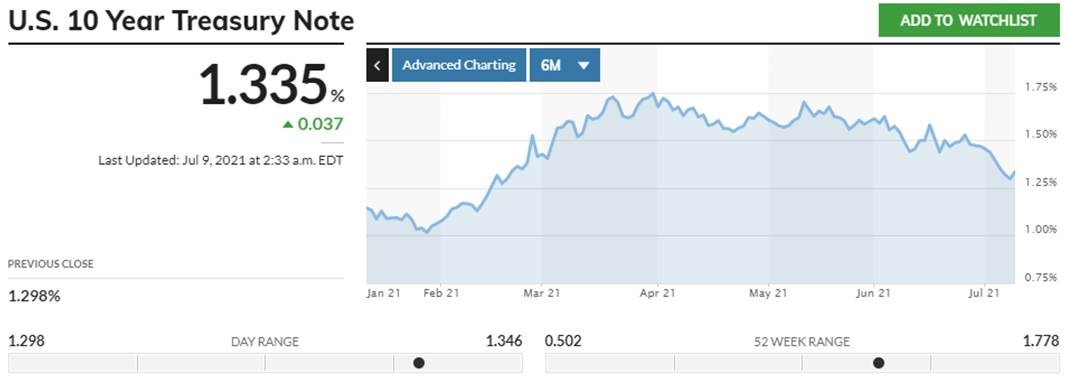

It is very often prudent to look through the noise and see what markets are telling us via their pricing function. From looking at the below we can clearly see that the bond market is not worried about inflation (at the moment)!

Source: www.marketwatch.com

After rising sharply in February long rates in the UK and US have fallen back to have almost retraced the rises seen in February as economies recovered from the worst of COVID lockdowns and investors started to price in interest rate rises sooner rather than later.

Summary

Bond markets are telling us inflation is transitory and interest rate rises are not imminent. This will please central bankers as this is the story they are telling.

Why is this important?

Everything is priced off the risk free rate and as these rates come down it is easier to justify paying higher valuations for other assets. In February long duration assets such as technology shares underperformed and more cyclical sectors such are oil & gas and mining outperformed.

Ones assessment of the outlook for rates is important for all investment positioning and at the moment the market is telling you something different than most of the analyst community. Being part of the analyst community I am allowed to say that I always prefer to side with the market!

Opinions constitute our judgement as of this date and are subject to change without warning.