Financial Fitness Test

Do you have a strong financial why and a measurable deadline?

Whatever your motivation, you have until the 5th April to make use of available personal tax allowances. The following ideas will help improve your financial fitness:

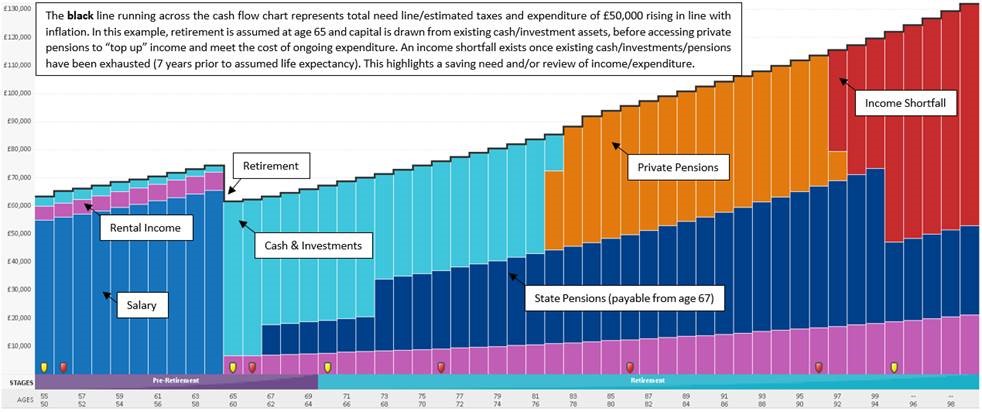

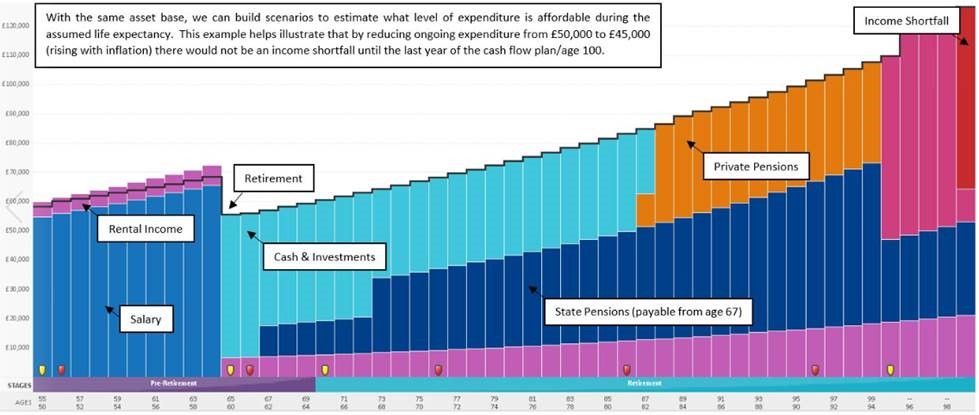

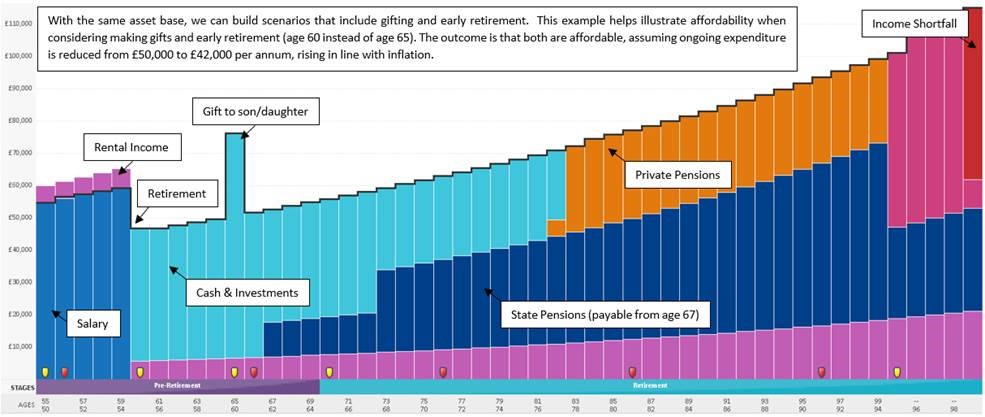

1. Consider a cash flow plan – helps those in need visualise:

“what retirement might look like” …which considers current/future spending patterns to see if there will be an income shortfall during their assumed life expectancy…

“if they have enough to live off in retirement” …this amount will vary for all of us, but it is a figure that we all need to know…

“if they have enough to gift sums away to family and retire early/step back from the business” …as in life, timing is key, and the cash flow places individuals in a more informed decision prior to making any life changing decisions…

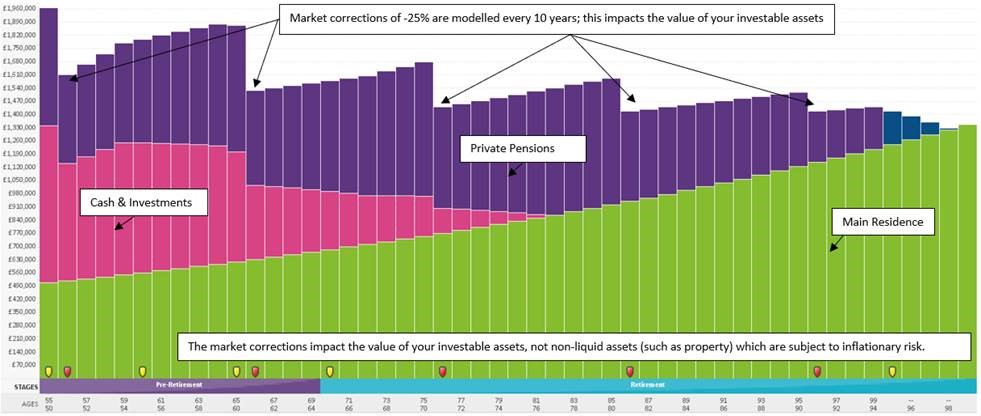

In addition to managing cash flow, the cash flow maps the value of non-liquid (i.e. property) and liquid (cash, investment and pension) assets. We include market corrections every 10 years to reflect a true market cycle to provide a more conservative view when illustrating a financial position in retirement.

Cash Flow planning is probably the biggest innovation in the financial planning industry over the last decade and has transformed the way we work with our clients.

Our clients financial situations change quickly, and by using our cash flow software, we are able to help, those in need, visualise their financial future, test different scenarios and instantly understand the impact of key decisions on life events along the way.

2. Invest into your ISAs – ISAs protect savers from Income/Capital Gains Tax on the underlying investments, which can provide a 20%/40% tax saving to basic rate/higher rate taxpayers.

If you have any surplus income, you should consider utilising this years’ tax allowance before 5 April – because if you don’t use it, you lose it!

3. Prioritise your Pension – If you are enrolled in a workplace pension scheme, you might want to consider enquiring into the maximum amount your employer will contribute on your behalf and consider raising your own contributions if there is scope for the company to raise theirs.

If you didn’t get the pay-rise and/or bonus that you deserved last year, then this is another way of increasing your overall remuneration without having to negotiate with the boss

4. Split your investments with your partner – if there is an unequal division of income, married couples and civil partners might want to consider equalising assets and/or maximising each person’s personal tax allowances.

A real worthwhile exercise that can be easily administered. Be proactive – the HMRC have been by freezing your personal tax thresholds and the potential increase of tax that you will pay.

5. Gifts to Children – different options are available when saving for children, you could consider investment into a Junior ISA (£9,000) or a pension (£3,600) each year. Both provide tax-free income and growth, with the pension providing immediate income tax relief of 20% on the contribution.

GIVEAWAY! GIVEAWAY! GIVEAWAY!

16 and 17-year-olds get two ISA allowances: JISA (£9,000) and Adult Cash ISA (£20,000). The contributions can be funded by parents/grandparents. The ISA allowance reverts to £20,000 at age 18, so use it or lose it!

6. Lifetime gifts – once you are comfortable that you have sufficient capital and income for your chosen lifestyle, consider outright gifts which can be effective for inheritance tax planning (IHT).

The IHT threshold has been frozen at £325,000 since 2009 and has been frozen until 2026. There are lots of options with regards to IHT, gifting funds being one of them.

7. Make time for Trusts – they are suitable for a number of scenarios, for example, a grandparent might consider using a bare trust to gift money to minor children which can be used to pay school fees. The advantage of using a bare trust in this way is that the money inside the trust is treated as belonging to the child for tax purposes, allowing them to make use of their personal tax allowances and exemptions which may otherwise go unused.

8. Life assurance – can help provide your beneficiaries and/or executors with money to pay off outstanding debts/IHT bill. This could help avoid having to liquidate assets, like property or investments, in your estate.

9. Family Investment – following the sale of a business, you may wish to consider establishing a Family Investment Company. The structure offers certain tax advantages and can be used to pass wealth tax efficiently to the next generation whilst, at the same time, safeguarding family assets.

10. Become a client – some say the smartest move that you can make! Feel free to get in touch for a chat, alternatively, see our website for more information on how to become a client: https://spinningfields.raymondjames.uk.com/becoming-a-client/