Bitcoin – Fools Gold?

On Monday 4th January 2021 in Hong Kong, a bitcoin trader was ambushed by robbers who stole cash and bitcoin before pushing him out of their car.

They stole 15 BTC equating to approximately $520,000 at the time…

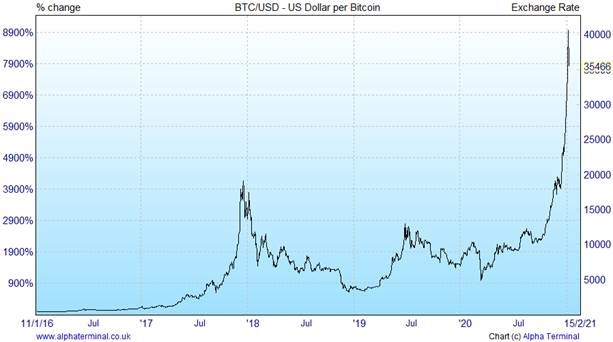

Having recently hit a record high price of $41,000 per bitcoin (BTC), there seems to be more and more hype surrounding the cryptocurrency. However, given the volatility of this asset, who knows where the price will be at the end of the week.

What is Bitcoin?

Launched in 2009, bitcoin is the world’s largest cryptocurrency by market cap and unlike pounds, dollars or euros, bitcoin is created, distributed, traded, and stored with the use of a decentralised ledger system, known as a blockchain.

As the earliest cryptocurrency and by far the most popular and successful, bitcoin has inspired a host of other digital tokens such as Ethereum and Ripple.

Why is Bitcoin back in fashion?

Corporate interest from banks such as JPMorgan, arguably one of the biggest banking names in the world, projects a price target of $146,000, which would match the total private sector investment in gold via exchange-traded funds, or bars and coins. JPMorgan did state that this price target is a long-term target and unsustainable for this year – but given the recent rally, who knows?

PayPal Holdings have also allowed cryptocurrencies on its platform, which is another reason for the recent rally. If bigger corporations are taking it seriously, then the appetite in retail investors grow, which in turn creates a speculative bubble. It is rumoured that Apple is considering it for Apple Pay.

Is Gold a fair comparison?

As a scarce resource, gold has traditionally been a hedge against inflation. Miners can’t flood markets with gold, whereas a government can debase their currencies by starting up their printing machines. Part of bitcoin’s appeal lies in the fact that it isn’t controlled by governments or their monetary policies, and that its supply is limited even more strictly than gold’s. ‘Halvenings’ (a bitcoin halving event is when the reward for mining bitcoin transactions is cut in half) help slow down the mining of new coins and production will cease entirely at 21 million coins (at the end of 2020, the tally was more than 18.5 million). With the vast spending by governments and central banks in response to the pandemic raising fears of inflation after economies recover, more attention than ever is being paid to bitcoin as “digital gold,” even as inflation remains muted.

Regulation

Perhaps the scariest thought behind all this is there is no regulation in bitcoin. This makes it a nightmare for central banks and regulators, let alone traders in Hong Kong. However, as bitcoin becomes a more common asset class, we would expect there to be increased regulation – how exactly, is a completely different story as who exactly is responsible for the regulation?!

Mt.Gox’s (a bitcoin exchange) case serves as a vivid example of why bitcoin traders should be cautious. A popular exchange collapsed and almost $460 million of users’ bitcoins went missing.

Final words

We find clients are frequently asking us about bitcoin and other cryptocurrencies and our answer is more or less the same every time – at the moment we wouldn’t invest our own money, let alone our client’s money, into something we don’t fully understand, which isn’t regulated. Watch this space as I don’t think this will be the last ramble about bitcoin, however, for the time being, the term ‘Fugazi’ comes to mind…