Goldilocks or Little Red Riding Hood?

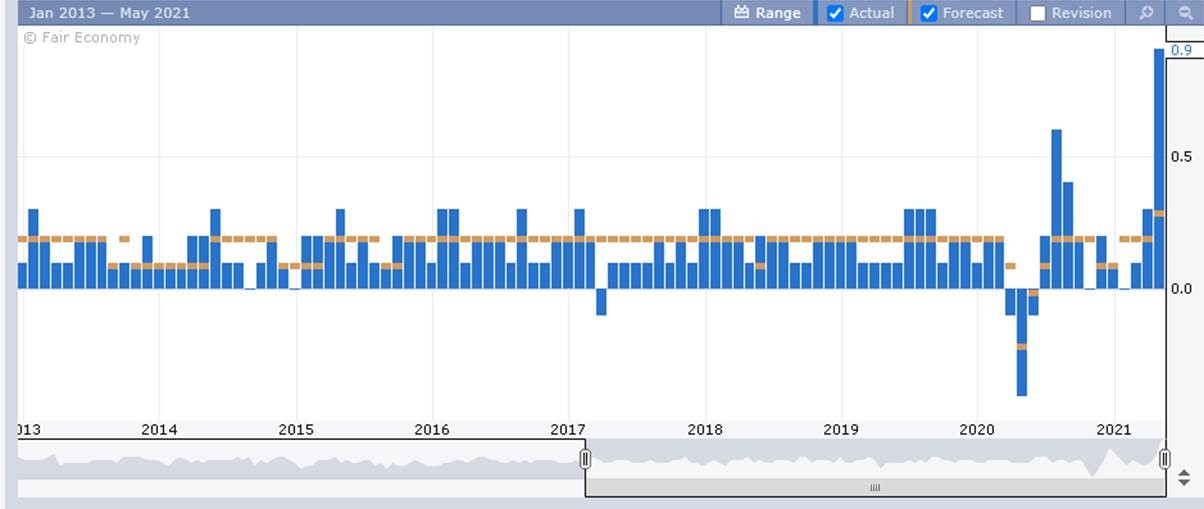

On Wednesday we had a monthly reading of US Core CPI (core consumer inflation) which has got the market asking the above question. The reading was +0.9% which is a huge jump month on month, the highest for 39 years and well above expectations.

Source – forexfactory.com

Why the question, Goldilocks or Little Red Riding Hood?

Investors were set on the notion of a ‘Goldilocks’ period for financial markets. A period when the global economy is running hot (but not too hot) on the back of a recovery from COVID pandemic so growth is strong but also policy makers are keeping interest rates low and remain accommodative (not too cold).

One thing that will spook central bankers (the wolf) and make them look to raise interest rates is persistent high inflation. Now the data on Wednesday was only one reading but if this trend continues then markets will start to question the ‘not too cold’ aspect of the Goldilocks scenario as they will expect central bankers to raise interest rates quicker than they are currently forecasting. This would have wide ranging consequences in the markets.

The immediate impact of this is easiest to see in the tech heavy Nasdaq which is sensitive to forecast changes in interest rates due to the long duration growth bias within this market. This market is down 4% this week on growing inflation concerns.

Which scenario prevails is very much in the balance but we will be watching future inflation data and commodity price moves very closely.

Opinions constitute our judgement as of this date and are subject to change without warning.