Why invest surplus cash?

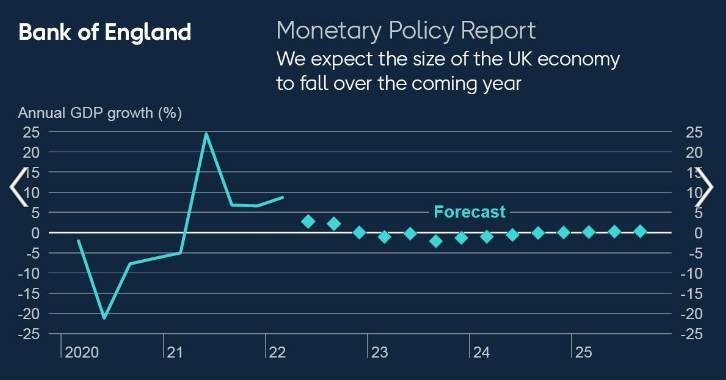

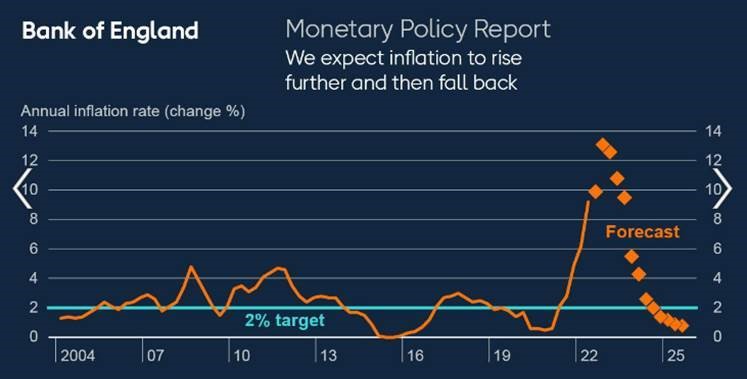

To benefit from real investment returns over the longer term. The Bank of England base rate is currently 1.75%, with the target rate for inflation set as 2%. High Street Banks are currently offering interest rates up to 1.71% which means that even with the best interest rate available, cash held on deposit is being eroded by the target rate of inflation by 0.29% per annum. With inflation currently tracking closer to 10%, now more than ever would be a good time to invest, as cash held on deposit could be losing as much as 8% in real-world terms!

In a high inflationary environment it is important to regularly review your cash reserves. This is because as the cost of living increases, and your cash holdings stay the same, the money in your account will be worth less. One solution is to invest surplus cash in the stock markets which provides the potential to deliver above inflation returns over the long term.

The Bank of England has forecasted inflation to fall in the new year, however they don’t expect it to be close to the 2% target for another 2 years.

Is your money working hard enough for you?

With investing, your capital is at risk. Opinions constitute our judgement as of this date and are subject to change without warning. This article is intended for informational purposes only and no action should be taken or refrained from being taken as a consequence without consulting a suitably qualified and regulated person.

Source: Bank of England