The big debate right now – inflation – structural or transitory?

This is the question that is playing out in the markets at the moment. Is inflation ‘structural’, meaning here to stay for the medium / long term or ‘transitory’, meaning a short term feature that will dissipate quickly.

Inflation rates are running higher than target in most developed markets. For example in the UK the most recent reading of Consumer Price Inflation (CPI) was 3.2% – significantly above the Bank of England’s 2% target.

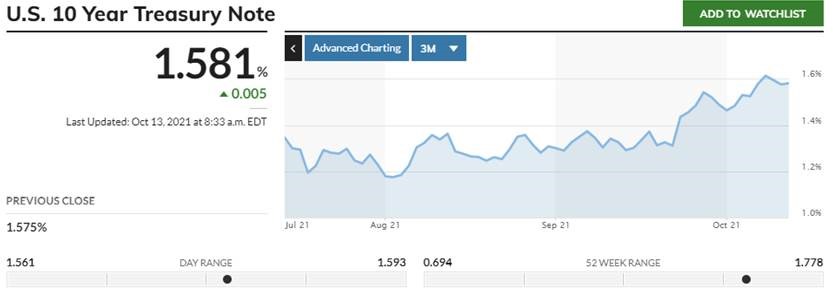

When we wrote in July on inflation the bond market was telling us that inflation was transitory but that story has changed with bond investors now expecting interest rate increases sooner than previously expected in the UK, US and Europe. Bond yields are moving higher accordingly. When bond yields move higher bonds investors, in general, lose money.

Source: www.marketwatch.com

What about stock markets?

The recent fall, albeit only a 5% drop, in the broad US technology index would indicate that stock market investors are also starting to price in some interest rate rises sooner rather than later with the central banks beginning to withdraw the punchbowl from the party which has been going since March 2009. This has led to a drop in risk appetite in the short term.

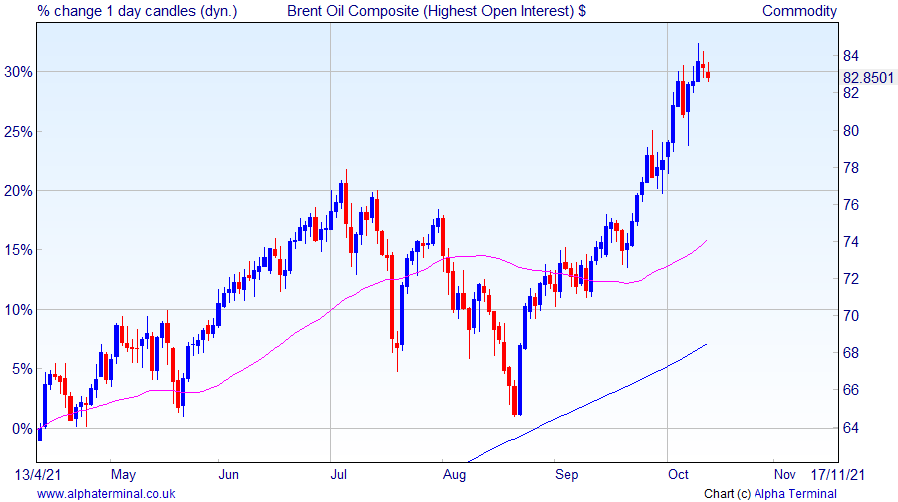

Source: alphaterminal

What about commodities?

Oil has taken off like a rocket but there is some external impact from energy supply issues. This is clearly inflationary.

Summary

It is still early days in the inflation debate but the narrative in the bond market has certainly started to shift and commodities are showing inflationary price moves. It always pays to listen to the signals from all markets to help form your world view.

In the current environment we would have exposure to assets than have the ability to perform well in an inflationary environment with interest rates rising. This would certainly not be traditional bond investments! We prefer alternative assets for our diversification from stock markets within our client portfolios.

Opinions constitute our judgement as of this date and are subject to change without warning.